The global Olive Oil demand is projected to rise at a CAGR of 5.6% from 2020 to 2025, reaching USD 21200 million by 2025, up from USD 17080 million in the previous forecast period.The olive oil industry is highly diverse, with demand distributed through developed and developing countries and realized across very different production processes, often within a single region. Olive oil is extracted regionally but traded globally; crushing operations are decentralized, while bottling has become increasingly centralized, with the strong involvement of multinational corporations. Around the same time, small bottlers with effective marketing campaigns are reaping the benefits of branding. Usage of olive oil is increasing, but consumption habits differ significantly in terms of quantity and consistency.

Analysis of the Olive Oil Market and Worldwide Research

The global Olive Oil demand is projected to rise at a CAGR of 5.6% from 2020 to 2025, reaching USD 21200 million by 2025, up from USD 17080 million in the previous forecast period.

The olive oil industry is highly diverse, with demand distributed through developed and developing countries and realized across very different production processes, often within a single region. Olive oil is extracted regionally but traded globally; crushing operations are decentralized, while bottling has become increasingly centralized, with the strong involvement of multinational corporations. Around the same time, small bottlers with effective marketing campaigns are reaping the benefits of branding. Usage of olive oil is increasing, but consumption habits differ significantly in terms of quantity and consistency.

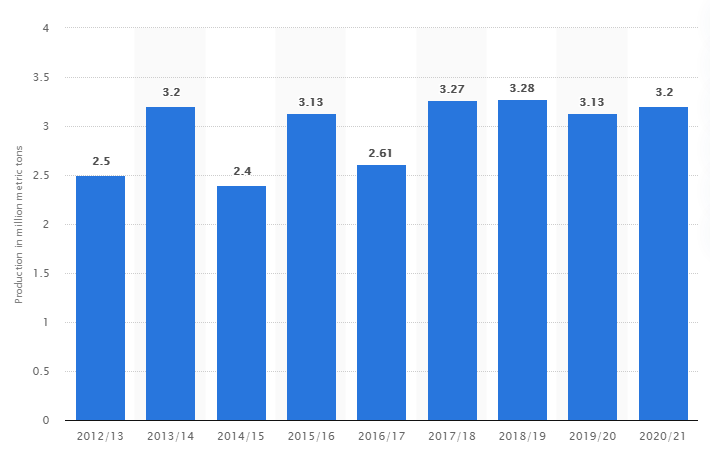

Market segmentation is the standard in some markets, and for some customers, premium product attributes play an increasingly significant role in purchasing decisions. The following figure shows the olives oils in substantial markets.

Despite preferential access granted to various Mediterranean nations, the European Union (EU), the world’s largest producer and user of olive oil, fiercely defends its domestic market. Any major exporters are also large importers, and some exporters manufacture no olive oil at all. Finally, the olive oil industry is marked by many conflicts of interest, both vertically and horizontally, in the “chain,” both domestically and between players from different countries.

Olive oil: global production volume 2012/13-2020/21 (Published by M. Shahbandeh, Jan 27, 2021)

Olive Oil Composition

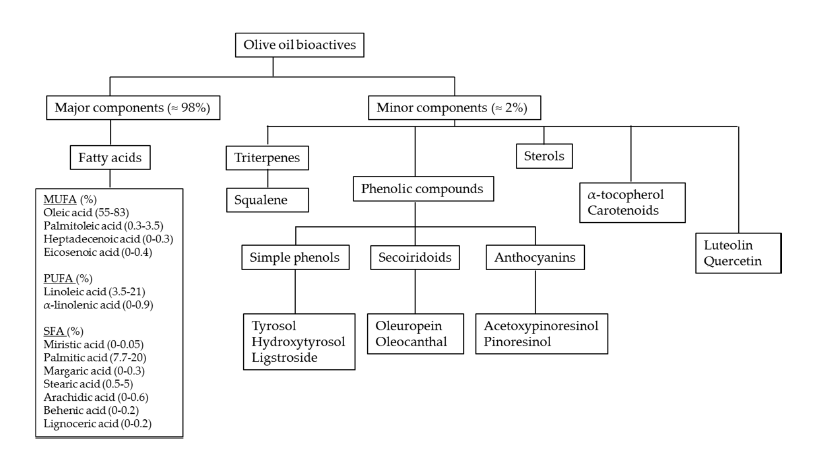

Olive Oil (OO) nutritional components are classified into two fractions in bromatological terms: a significant saponifiable fraction and a small non-saponifying fraction (Figure 1). Oleic acid, a monounsaturated fatty acid (MUFA), is the most representative factor, accounting for 55 to 83% of total fatty acids. Minor components of extra-virgin olive oil (EVOO) account for just 2% of the total weight of OO and contain triterpenes, sterols, tocopherols, carotenoids, and phenolic compounds, among others (Figure 1). These minor components are a protective mechanism for the plant against the pro-oxidative conditions found in southern European latitudes. The concentrations of these minor compounds play an essential role in determining the consistency, stability, and nutritional value of EVOO. The phenolic components of OO have recently piqued the scientific imagination. The most common phenolic compounds are hydroxytyrosol (3,4-dihydroxyphenyl ethanol) and tyrosol (p-4-hydroxyphenyl ethanol), as well as their derivatives such as the secoiridoids oleuropein (3,4-dihydroxyphenyl ethanol elenolic acid), oleocanthal, and oleacein. The anti-atherosclerotic, anti-inflammatory and antioxidant properties of OO polyphenols have been linked to their beneficial function.

Figure 1. Bioactive composites in extra-virgin olive oil [1]

Volatile flavour components of olive oil

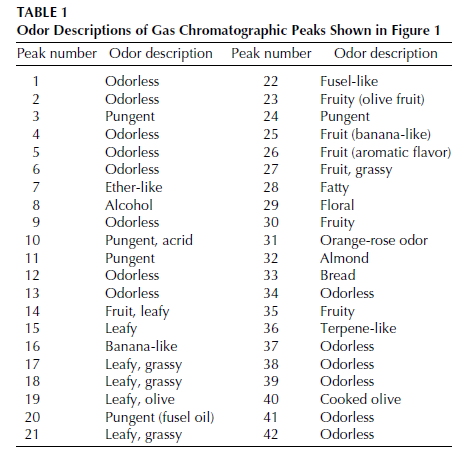

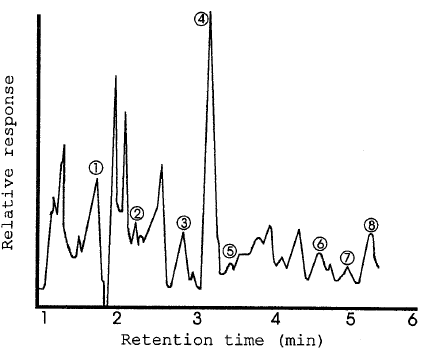

Several components that contribute to olive oil’s fragrance have been established. This involves various saturated aldehydes ranging in carbon number from C7 to C12, with C10 predominating. When compared to other flavour molecules, aldehydes are often present in more immense proportions in olive oil. Green and black olives have 50% and 75% aldehyde content, respectively. Olive oil aroma compounds are aliphatic and aromatic hydrocarbons, aliphatic and triterpenic alcohols, aldehydes, ketones, ethers, esters, furan, etc., thiophene derivatives, and furan and thiophene derivatives. The most volatile compounds in olive oil are hexanal, trans-2-hexenal, 1-hexanol, and 3-methylbutanol. Figure 2 and Table 1 show a gas chromatography profile of olive oil flavour components and odour descriptors.

Figure 2. Presence of Phenolic compounds in olive fruit of cultivar Koroneiki [2]

| Peak No | Phenolic compounds |

| 1 | shikimic acid |

| 2 | gallic acid |

| 3 | pyrogallol |

| 4 | gentisic acid |

| 5 | protocatechuic acid |

| 6 | p-hydroxybenzoic acid |

| 7 | 4-hydroxy-3-methoxy-phenyl acetic + hydroxycaffeic acid |

| 5 | syringic acid + caffeic acid + vanillic acid |

Table 1. Odour description for peaks in figure 2 [2].

Factors affecting the formation of flavour components

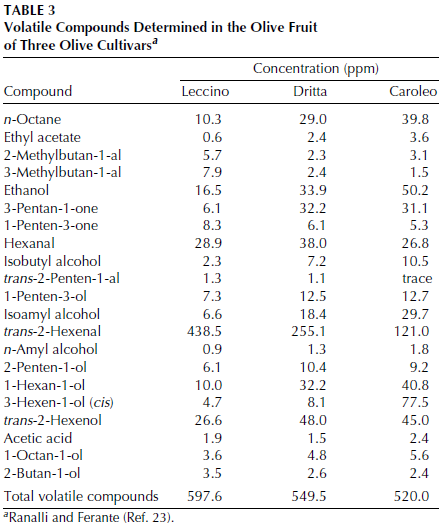

Many aspects influence the appearance of flavour components in olive oil. Under similar environmental and cultivation conditions, different cultivars can produce oils with varying flavour compounds and, as a result, sensory characteristics. Montedoro et al. investigated the formation of volatile and phenolic constituents in three Italian cultivars (Canino, Frantoio, and Moraiolo) and discovered only quantitative variations in volatile components. The patterns of heterogeneity and phenolic constituent concentrations in the three cultivars were strikingly similar. The esters, alcohols, and aldehydes distributions in the three cultivars differed equally over the maturation period. Table 3 indicates the volatile flavour compounds found in three more cultivars. The highest concentration is trans-2-hexenal (Table 3).

Table 3. Volatile compounds in the olive fruit of three olive Cultivars [2]

Climate, cultivating methods, fruit maturity, storage conditions, and manufacturing processes affect the development and inclusion of flavour (volatile and phenolic) compounds in olive oil. As a result, the taste consistency of olive oil can vary greatly. Today, both manufacturers and customers are worried about the flavour of virgin olive oil. These elements, however, have not yet been thoroughly researched. We don’t know how much variation in the scent and taste of olive oil is due to the cultivar, the climate, or other influences. Cultivars, orchard pedoclimatic pressures, and farming methods, along with olive ripeness and olive oil extraction techniques, result in a wide range of chemical profiles in olive oil.

Challenges

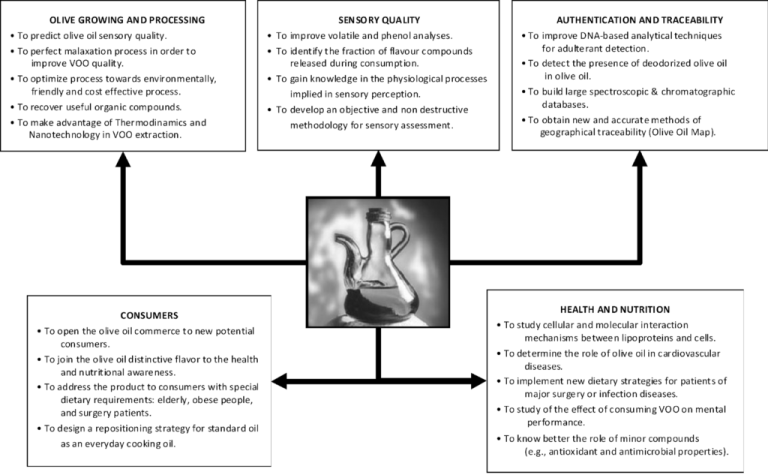

As the components of olivefruit are examined, water and oil account for 85-90% of the weight of the pulp, with the remainder mainly consisting of organic matter and minerals. This fraction comprises major compounds, mostly triacylglycerides, and a diverse number of minor compounds (sterols, alcohols, hydrocarbons, pigments, volatiles, phenols, etc.). These compounds serve as the foundation for addressing questions and confronting problems classified into five major categories (Figure 3): olive growing and processing, sensory consistency, authentication and traceability, health and nutrition, and customers.

Figure 1. Challenges for scientific research on olive oil.

Scope

More research is required to determine the volatile components of olive oil are directly responsible, and to what degree, for the distinctive and delicate taste of good-quality olive oil. A multilevel research strategy is recommended for improving the consistency and increasing the quantity of olive oil. It is considered beneficial to consider newer genetic modification approaches to improve the health and productivity of the trees.

The hunt for better ways to neutralize and potentially kill the common enemy of olive production, the olive fly Dacus oleae, should be strengthened. Olive fruit harvesting practises must be modernized. When farm labour grows more scarce, the mechanical means of effectively and reliably harvesting the fruit must be mastered. Improved methods of preserving the fruit before processing should also be tried. For olive mills with small space, the need for better fruit storage facilities is much greater. Although many developments on efficient olive processing machinery had made, there is still room to increase the fruit’s oil extraction quality. The use of enzymes to aid in the release of oil from tissue should be investigated further. Since antioxidants can extend the market life of olive oil, further research into applying these additives to olive oil preservation is warranted. The claim that olive oil use has a significantly beneficial impact on human health requires more support. The trans isomerization of oleic acid during the heating of olive oil for culinary purposes begs to be investigated.

Finally, the use of olive oil industry byproducts should be investigated further. The anthocyanin contained in mature olive skin is one example of a potentially valuable olive byproduct. Another example is the sugars in olive tissue’s aqueous process, which may be subjected to alcoholic fermentation after the oil is extracted.

Food Research Lab is a global Contract R&D Food, Beverages & Nutraceutical Lab providing solutions to Food, Beverages and Nutraceuticals (F, B&N) industries worldwide.

FRL is the unit of Guires Group. With years of experience in research, especially in medical devices, pharmaceutical regulations, food product development, scientific publications and clinical trials, Guires Group has ventured into food research forming a separate unit under the brand name of ‘Food Research Lab’ to drive food innovations forward. Food Research Lab brings together the latest advances in food processing equipment, expert food scientists, chefs, nutritionists and partners from across the globe to help food, beverage & nutraceutical companies and entrepreneurs get their products to market quickly and effectively.

Food Research Lab makes your dream concept a commercial product, integrating our strong knowledge of ingredients and processing techniques to help you make the right decisions.

Let’s create something Innovative and Delicious together

Food Research Lab strives for excellence in new Food, Beverage and Nutraceutical Product Research and Development by offering cutting edge scientific analysis and expertise.