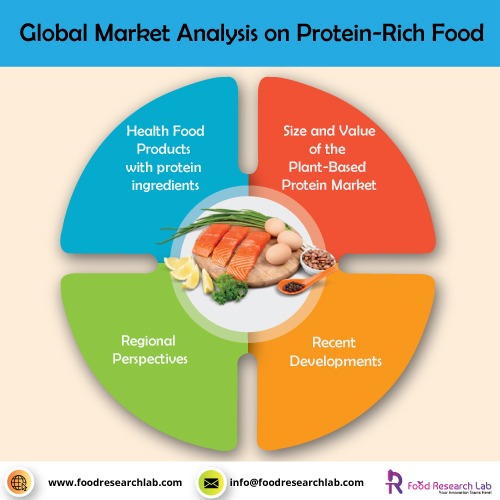

Health Food products made with protein ingredients, such as margarine, frozen cuts, baking products, spreads, yoghurt, and milk sausages, gain traction and see high demand. The demand is also growing due to the increased use of these goods by health-conscious and elderly customers. Furthermore, an increase in the development of many proteins by numerous manufacturers that contain a large variety of amino acids and perform unique functions such as satiety, muscle recovery, weight reduction, and energy balance is expected to provide the industry with enormous growth opportunities.

Global Market Analysis on protein rich food

Introduction

Health Food products made with protein ingredients, such as margarine, frozen cuts, baking products, spreads, yoghurt, and milk sausages, gain traction and see high demand. The demand is also growing due to the increased use of these goods by health-conscious and elderly customers. Furthermore, an increase in the development of many proteins by numerous manufacturers that contain a large variety of amino acids and perform unique functions such as satiety, muscle recovery, weight reduction, and energy balance is expected to provide the industry with enormous growth opportunities. (1)

Size and Value of the Plant-Based Protein Market

The demand for plant-based proteins was valued at USD 16.45 billion in 2018 and is expected to reach USD 40.53 billion by 2025, growing at a CAGR of 13.75%. Customers’ willingness to follow a vegan diet is expected to accelerate the global plant-based protein market’s expansion.

Product Suggestions

- Animal-based proteins dominated the industry in 2020, accounting for more than 70.0% of global sales. Animal protein foods have several nutritional advantages that have been proven by empirical research and accepted by government food development company. The high demand for animal-based ingredients drives up consumption, accelerating the segment’s growth over the projected period. For example, in cancer patients undergoing chemotherapy, whey improves glutathione (GSH) levels while also improving nutritional status and immunity. (2)

- Plant proteins are less costly than animal-derived proteins, which are expected to drive the plant segment’s development over the projected era. Furthermore, in North America and Europe, the increasing wave of veganism is fuelling the intake of plant-based ingredients. The belief that plant-based products are better than their animal-based counterparts has led to an increase in soy and wheat-based products. Pea protein has a smaller market share than soy and wheat protein, but it is projected to grow at a 12.9% revenue-based CAGR over the forecast period.

- Due to their use in the personal care and cosmetics industries, cereal-based ingredients are projected to see substantial growth in demand. Corn-based materials are used as abrasives and absorbents and binders in eye and face cosmetics, fragrances, hair care, hair colouring and hair colouring, nail and oral care products.

- The increasing use of legumes as a source of protein in vegan diets and foods is driving the legume-based proteins market. In addition, the consumption of legume-based snacking items is expected to boost segment growth. Consumer awareness of healthier foods is being driven by rising health conditions such as obesity, stomach issues, and diabetes. This is shown by the fact that legumes help avoid and treat various health problems, such as cell loss and high blood pressure. Food product development and formulation companies have involved to do research on legume-based proteins.

- The market for micro-based proteins has grown in recent years due to increased animal feed applications. The increasing use of microbe-based proteins in aquaculture feed is one of the key factors driving the segment’s development. This is due to the global expansion of fish production, which now accounts for half of the world’s fish supply for human consumption. The number is expected to rise in the coming years, resulting in increased demand for microbe-based proteins, crucial in providing overall nutritional value and high-quality amino acids to the aquaculture industry.

Regional Perspectives

In 2020, North America led the industry, accounting for more than 40.0% of global sales. Increased intake of chips, frozen cereals, and energy bars are driving up demand for protein ingredients. The launch of new products by Mead Johnson and Cargill, Inc., such as Enfamil Human Milk Fortifier Liquid High Protein, to meet market demand for cholesterol-free and low saturated fat drinks is projected to drive product demand much higher. (3)

Germany has the highest share of sales in the European region in 2020. The increase of Germany’s senior population has fueled demand for medical, nutritional products that aid in bone and muscle preservation. In the near past, this has boosted appetite for these ingredients. Furthermore, the role of protein ingredients in Alzheimer’s disease treatment has positively affected the German market. (4)

Due to the developing consumer markets in countries like China and India, Asia Pacific is projected to rise at the fastest pace in sales during the forecast period. Because of the easy supply of raw materials, China is one of the world’s leading producers of plant and animal-based products. In China, soy protein is commonly eaten, accounting for over 91% of the country’s plant-based protein market. Furthermore, over the next few years, South Korea, Malaysia, Indonesia, India, and China are expected to see increased demand for food product devlopment and packaged foods and beverages. (5)

Europe – the current largest and fastest-growing market

The European industry controlled the lion’s share of the market. This domination may be due to the region’s high consumption. Europe consumes more than twice as much as the rest of the world. The high-protein trend in food and drinks and personal care and cosmetics is gaining traction in Germany as protein claims on new food and beverage releases begin to rise. The rising prevalence of health-related issues, combined with a focus on food safety, flavour, and freshness, is changing food demand. As a result, the market for protein ingredients is expected to expand.

Recent Developments

- In May 2020, Cargill and Procter & Gamble will partner to launch nature-powdered engineering, paving the way for more powerful products in the future.

- In October 2019, Cargill announced plans to spend $USD 225 million in a Sydney, Ohio facility to serve local farmers better and satisfy the demand for protein and refined oils.

- ADM increased its ingredient collection in November 2017 with the introduction of Nutriance, a line of wheat protein concentrates with applications in sports and senior nutrition.

- In August 2018, ADM launched a new technological innovation centre in Shanghai to create flavours and ingredients.

- In March 2019, Dupont introduced plant protein nuggets from its SUPRO and TURPRO product lines.

Let’s create something Innovative and Delicious together

Food Research Lab strives for excellence in new Food, Beverage and Nutraceutical Product Research and Development by offering cutting edge scientific analysis and expertise.